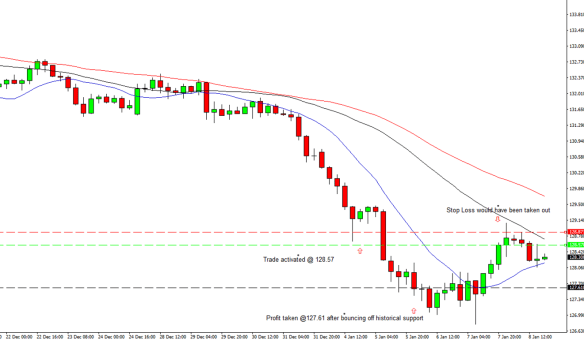

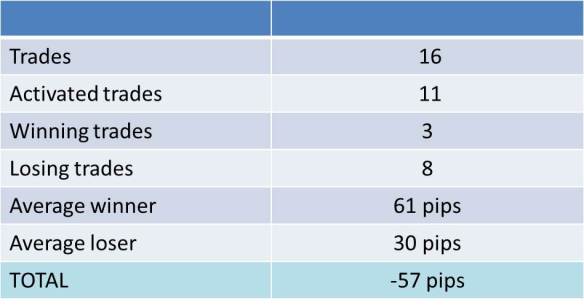

February is over, and so ends the most pitiful and infuriating month of my trading career so far. I finished the month on -57 pips, which given the circumstances could have been a lot worse. I caught a big winner on the eur/jpy which brought me back from my lowest point of -176, and made the score sheet look slightly less catastrophic.

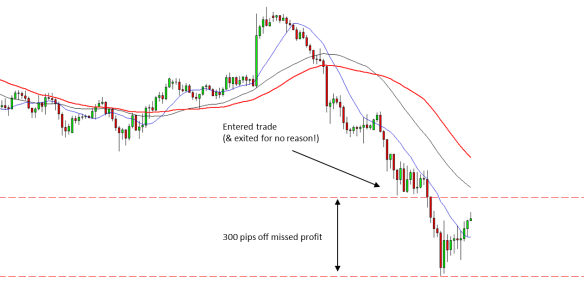

I had two golden opportunities to finish the month in profit, both of which would have been realised by just keeping my live trades open. Another trade was stopped out by 1 pip, and then raced away for a further 400. This one I can live with though. It was well within my rules, and I was simply beaten by the unavoidable cruelty of trading probability. The others though were utterly intolerable, and I fully deserve to have finished the month in the red.

So let’s draw a line under all this. If I can internalise the learnings from this terrible month and it only costs me 57 pips, then this might be the best month I ever had.

What made me cash out was a sudden panic that the trade wasn’t moving as quickly in my direction as I would have liked. Had I not been checking my MT4 trading app on my phone, I wouldn’t even have been aware of it until the next morning, by which time I could have closed out for a 150 pip gain.

What made me cash out was a sudden panic that the trade wasn’t moving as quickly in my direction as I would have liked. Had I not been checking my MT4 trading app on my phone, I wouldn’t even have been aware of it until the next morning, by which time I could have closed out for a 150 pip gain.