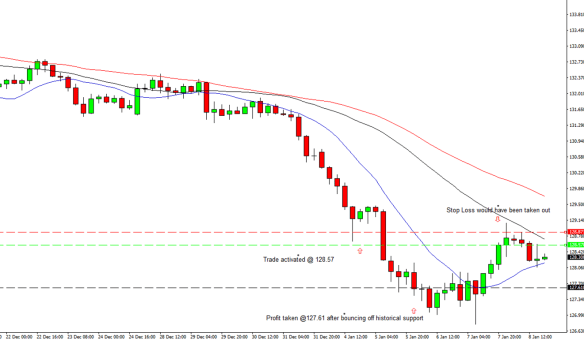

It’s better to take a small, manageable loss and be ready to enter the trade again at a different price, than to exit with a few quick pips, only to see the trade escalate into a 3-month monster. The problem is that it doesn’t feel like that when you’re in the moment. 20 pips is 20 pips, right? 4 of those and you can put your feet up for the rest of the month.

This week I picked an entry on the NZD / USD which went immediately in my favor, but found myself trying to find reasons / excuses to exit with a small, tidy profit. I’m pleased to say I held my ground and instead just moved my stop to zero. I may very well make nothing off this trade, but I could also end up with 500 pips, and that for me is worth the risk.

The challenge with trading is that the monsters are rarely visible from the surface. You can only see them by putting your head under the water. Sometimes you have to hold your head down there for so long, that every nerve in your body will be screaming at you to get out. All that’s visible from the surface are a few quick pips here and there, which in the long run will be vastly outnumbered by your losers. Have patience though, because the monsters be out there, and they’re the only thing that can save you.